People like you were also interested in

Features

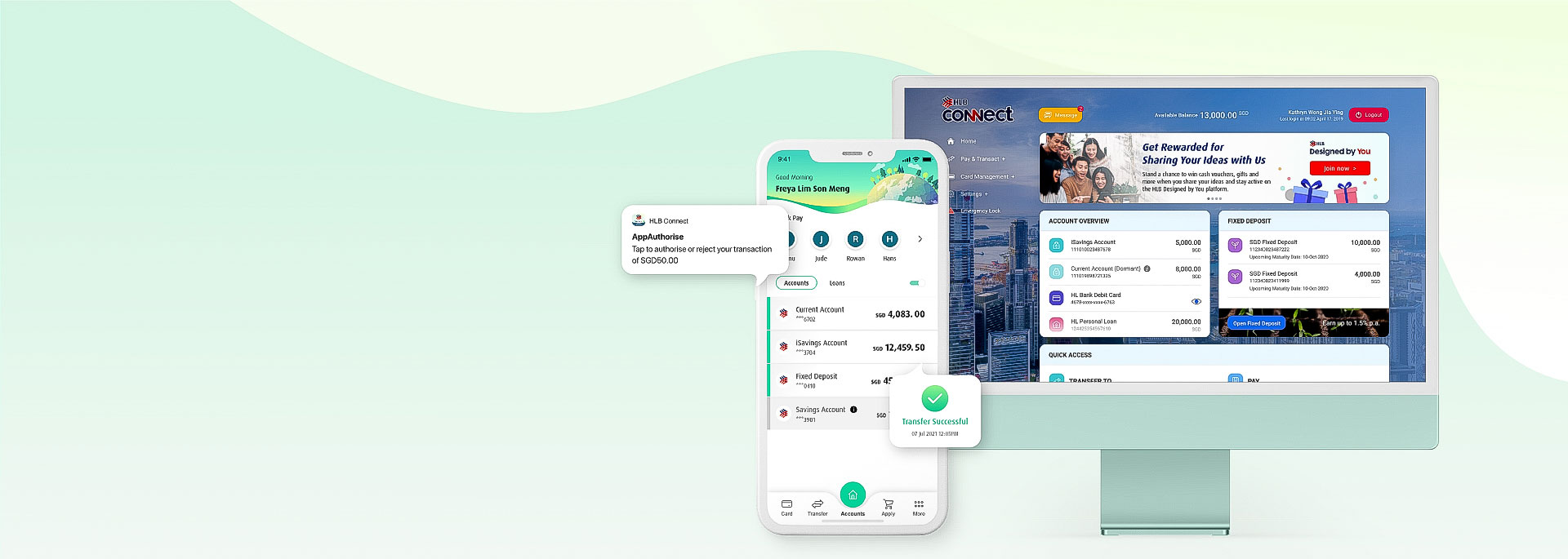

AppAuthorise Digital Token

Authorise online banking transactions in a single tap while transactions through your mobile app are authorised seamlessly in the background.

More details

Less details

Authorise online banking transactions in a single tap while transactions through your mobile app are authorised seamlessly in the background.

More details

Less details

Emergency Lock

Immediately suspend access to online and mobile banking if you believe your account is compromised.

More details

Less details

Immediately suspend access to online and mobile banking if you believe your account is compromised.

More details

Less details

Singpass Login

Login instantly with one tap using your Singpass App.

More details

Less details

Login instantly with one tap using your Singpass App.

More details

Less details

Account Overview

Check your account balances and details from anywhere, 24/7.

More details

Less details

Check your account balances and details from anywhere, 24/7.

More details

Less details

Transaction Limits

Set daily limits for different transaction types.

More details

Less details

Set daily limits for different transaction types.

More details

Less details

Transfer funds

Transfer funds effortlessly. No queues, no hassles.

More details

Less details

Transfer funds effortlessly. No queues, no hassles.

More details

Less details

Favourite Accounts

Add your favorite accounts for easier and quicker transfers.

More details

Less details

Add your favorite accounts for easier and quicker transfers.

More details

Less details

Email Address

Update your email address where you would like to receive notifications from us.

More details

Less details

Update your email address where you would like to receive notifications from us.

More details

Less details

Transaction Receipts

Save or share transaction receipts to recipients.

More details

Less details

Save or share transaction receipts to recipients.

More details

Less details

AppAuthorise Digital Token

Authorise online banking transactions in a single tap while transactions through your mobile app are authorised seamlessly in the background.

More details

Less details

Authorise online banking transactions in a single tap while transactions through your mobile app are authorised seamlessly in the background.

More details

Less details

Emergency Lock

Immediately suspend access to online and mobile banking if you believe your account is compromised.

More details

Less details

Immediately suspend access to online and mobile banking if you believe your account is compromised.

More details

Less details

Transfer funds

Transfer funds effortlessly. No queues, no hassles.

More details

Less details

Transfer funds effortlessly. No queues, no hassles.

More details

Less details

Account Overview

Check your account balances and details from anywhere, 24/7.

More details

Less details

Check your account balances and details from anywhere, 24/7.

More details

Less details

Transaction Receipts

Save or share transaction receipts to recipients.

More details

Less details

Save or share transaction receipts to recipients.

More details

Less details

Favourite Accounts

Add your favorite accounts for easier and quicker transfers.

More details

Less details

Add your favorite accounts for easier and quicker transfers.

More details

Less details

You may refer to our FAQ here.

How to register for HLB Connect?

- You will need a Current, Savings or Fixed Deposit Account.

If you don’t have one, open one here. - Please go to https://www.hlbankconnect.com.sg/rib and click on "Register for Online Banking".

- Click "Retrieve Myinfo with Singpass" and scan the QR code to verify your identity.

- If you don't have Singpass, visit us at HL Bank or mail to us the eConnect form.

We will issue a Temporary ID to you. Once you receive it, please visit our page again and click on "Register for Online Banking". - Enter your Account number and SMS OTP.

- Create your username and password to login.

HLB Connect Security Information

If you suspect that there has been any unauthorized access to your account(s) online, or that any online transaction has taken place which is not initiated by you resulting in any losses, please contact us at + 65 6028 9800.

Safeguarding your data has always been our priority, and in doing so, we have incorporated the following features:

- Alphanumerical requirements for passwords

- Singpass authentication for registration and resets with HLB Connect (for Singaporeans, PR and FIN holders)

- Temporary IDs for registration and resets with HLB Connect

- Multi-layered authentication process for transactions

- Automatic log off after prolonged inactivity

- Deactivation of accounts

- Security question will be used to verify your identity if the system detects suspicious behaviour on your HLB Connect account. You will need to answer the Security Question correctly to proceed

- As part of our on-going security measures, and to safeguard your account, our HLB Connect App has been enabled with a security feature to protect customers from malware scams. Find out more on our malware shielding security feature.

Phishing

In most cases, passwords and usernames are obtained when they are entered into the fields on an imposter website that replicates the original website. Such links can be sent through emails, and in more recent cases texts and web based chats.

Keystroke Logging

Keystroke logging obtains passwords by monitoring and recording a user’s typing patterns on the keyboard. This can be captured through hardware and software.

Spyware

Spyware is a computer software that is often installed into a PC without user's knowledge and usually takes place during user's download of free software, games or subscribing to free online services from the Internet. Once installed, it does not only monitor user's surfing activity but also capable of retrieving any personal and sensitive information that is being transmitted on the Internet before it is sent in the background to interested parties.

Telephone Tapping

Phone tapping is the unauthorised monitoring of telephone and internet conversations and/or key tone. One way that this can be done is through Bluetooth connections.

Malware Alert

Passwords and usernames can be obtained through the use of malware. Malware programs can be installed when a user clicks on an unknown link, an email attachment, or any attachments sent through other applications.

Login Spoofing

Login spoofing is a way of obtaining a user's username and password. The user is presented with the bank's Login page to prompt for the username and password. When the username and password are entered, the information is then passed to the attacker.

Trojan Horse

Trojan horse is a type of malware (malicious software) which allows unauthorised access by attacker to user's computer and more often for the purpose of data theft (e.g. personal information, bank account numbers and password). It can be spread through opening email attachments from unknown person or visit to unknown websites.

Password Cracking

Using this method, passwords are repeatedly guessed until access is granted.

Shoulder Surfing

Passwords and usernames are obtained using this method by observing your devices when passwords and usernames are entered.

Mule Scam

As the result of responding to spam email or job recruitment that offers opportunities to make easy money, a person could fall for a mule scam. This person is known as "money transfer agent" or "money mule" whereby a mule's bank account is used to receive stolen money from phishing victims and such account also act as a transit prior to the funds being sent abroad and later to be withdrawn by the fraudsters.

We have put together a guide on how to bank online safely.

Vigilance Is The Key

Keeping yourself updated with the new types of online threats can allow you to pick up on scam methodologies.

See www.singcert.org.sg to find out more on the latest internet threats.

Don't Click

Website addresses should always be manually keyed in. Never click on access links provided by separate applications (e.g. SMSes, pop ups, emails etc.).

Keep It At Home

Never use a public computer or an unsecured wireless network

(“WIFI”) when performing online transactions.

Look Out For the Padlock on Your Browser

When visiting websites that require you to share your security information. Make sure it's there as the icon indicates that the website uses a secure connection. When it comes to your online safety. Visit www.mycert.org.my to find out the latest internet thread

Use a single device to perform all banking related access and transactions

For your convenience, you will be able to receive the OTP, access Internet Banking, and perform on-line banking transactions on your device. Please note however that you will need to keep your device secure at all times (both in terms of physical care as well as preventing software viruses/hacks) to prevent any loss to or unauthorised transactions on your account.”

Shred or Securely Store

Documents with personal data should always be securely stored or shredded

Make It Complicated

Ensure that passwords created are a combination of alphabets and numbers. Passwords should also be changed regularly.

Disable Auto-complete & Auto-save

Usernames and passwords should not be subjected to the autosave function on your devices

If You Doubt It, Junk It

No matter how legitimate it may seem, never respond to unsolicited emails.

Sharing Is Not Always Caring

Never share information such as your usernames and passwords via emails or pop-up windows and phone calls

Check & Monitor

Reconcile your transaction records frequently to ensure that any suspicious transactions can be reflected as soon as possible.

Don't Keep Your Cache

After every online session, clear your browser cache.

Invest A Little

Consider investing and updating computer securities, such as firewalls, anti-spy and anti-virus software.