Effortless Transfers & Seamless Payments

at Your Fingertips

Going cashless with just your mobile phone

Scan to pay at any merchants with HL Bank QR Pay!

Receive payment instantly with a QR code

Generate your unique QR code in the HLB Connect App and start receiving payments instantly and securely

How to

Pay & Receive Payments via QR Pay

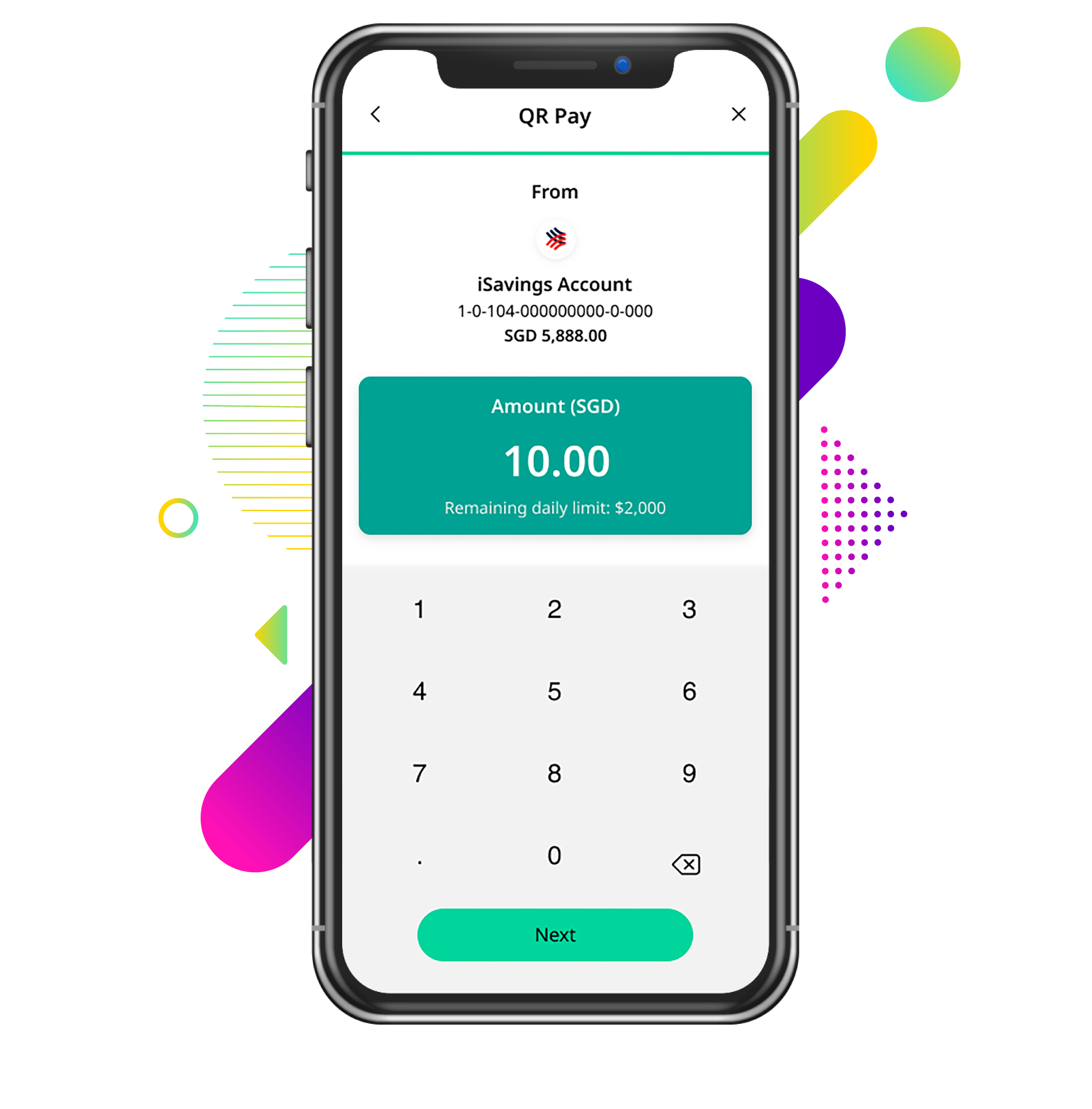

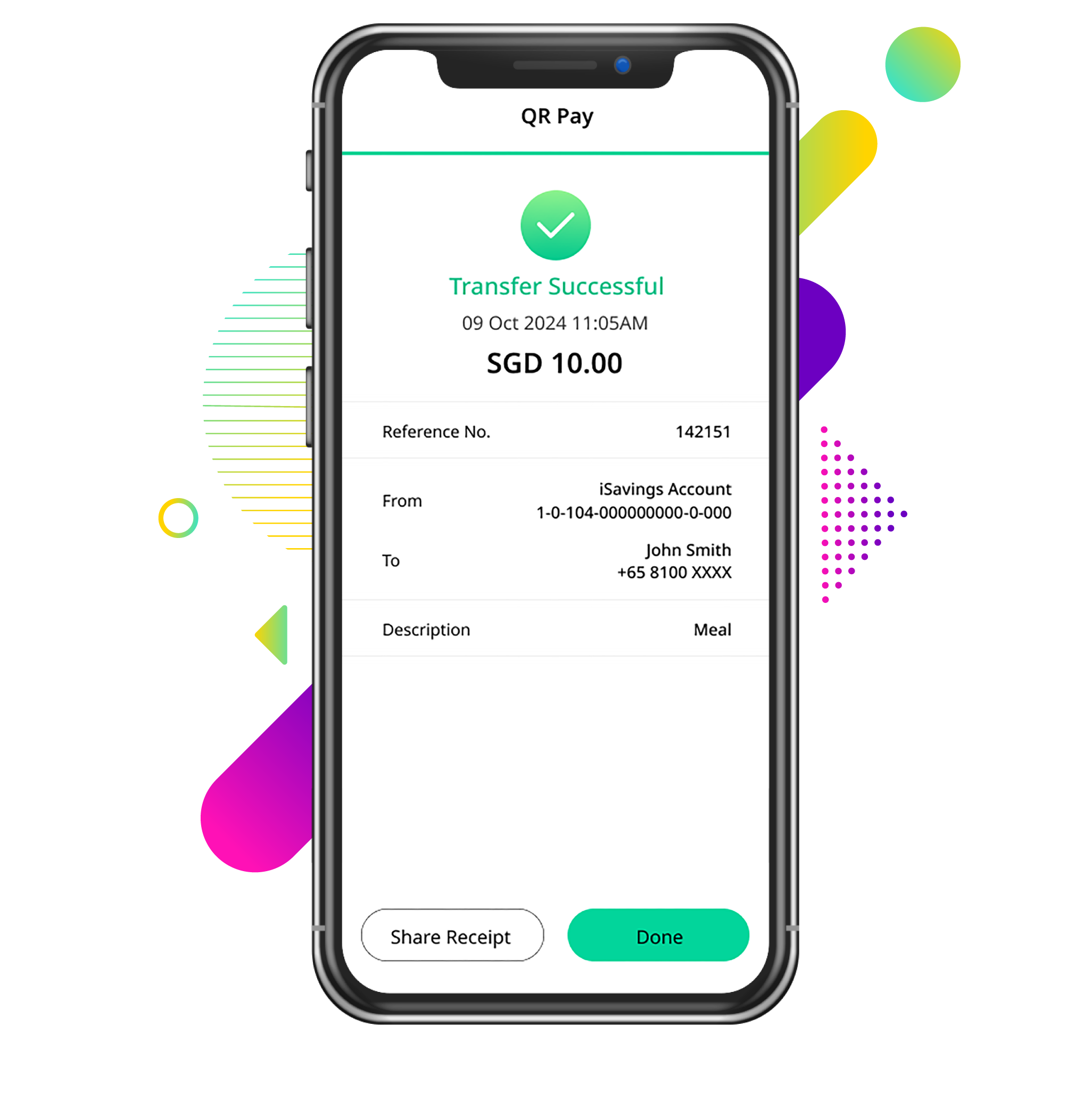

To Scan & Pay via QR Pay

- STEP 1:

- Open HLB Connect App and tap QR Pay

- STEP 2:

- Scan the recipient’s or merchant’s QR code and enter payment amount

- STEP 3:

- Review payment details and swipe to transfer

One-time Registration to Receive Payments

- STEP 1:

- Open HLB Connect App and tap QR Pay

- STEP 2:

- Click on Register here to perform PayNow registration

- STEP 3:

- Select your preferred ID and link it to your HL Bank account

- STEP 4:

- Tap Receive Payments to generate your unique QR code

- STEP 5:

- Share your QR code to receive payment instantly

Send money without a bank account number

With PayNow, all you need is the recipient’s Mobile Number/NRIC/UEN/VPA to send money instantly and securely

Receive transfers instantly with your mobile number

Register your mobile number through HLB Connect to receive money instantly from anyone

Faster payouts with NRIC/FIN registration

Link your NRIC/FIN to your HL Bank PayNow to receive faster government & insurance payouts

How to

Send & Receive Money via PayNow

To Send Money

- STEP 1:

- Open HLB Connect App and tap Transfer

- STEP 2:

- Tap “+” to add payee, then select Mobile Number

- STEP 3:

- Enter recipient’s mobile number and transfer amount

- STEP 4:

- Review transfer details and swipe to transfer

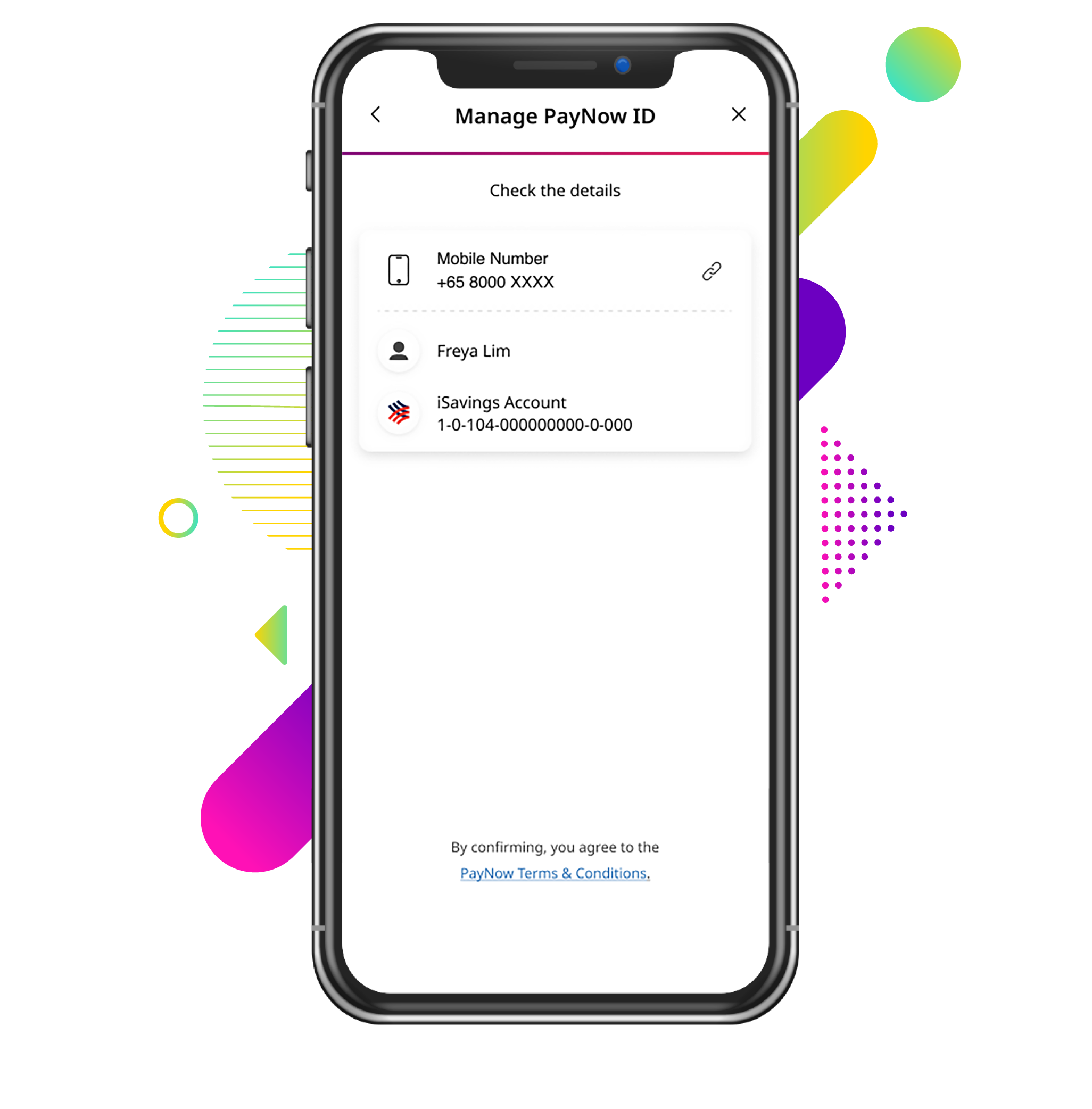

One-time Registration to Receive Money

- STEP 1:

- Login to HLB Connect App and tap More

- STEP 2:

- Tap on Manage PayNow ID

- STEP 3:

- Select your preferred ID and link it to your HL Bank account

- STEP 4:

- Once registered, you can receive PayNow transfers instantly using your registered ID

FREQUENTLY ASKED QUESTIONS

PayNow is an electronic fund transfer service that allows you to transfer SGD funds instantly to a payee, using the payee's designated mobile number, NRIC/FIN or UEN number instead of his/her bank account number

A payee can receive funds via PayNow as long as he/she has a Singapore bank account with one of the PayNow participating banks, and has registered his mobile number, UEN, or NRIC/FIN as a PayNow Proxy with the participating bank.

You can register for PayNow via HLB Connect or HL Connect mobile application. During registration, you will be asked to (1) select the deposit account that you want to link to your selected PayNow Proxy (mobile number and/or NRIC/FIN number), and (2) set a PayNow Nickname for your registration.

Scan and Pay via PayNow QR:

- Select Scan and Pay from the login page of HL Connect Mobile Application

- Scan the QR Code

- Enter the transaction amount, Account paying from and other details - Verify details, and submit

Receiving Funds:

- Inform sender of your designated PayNow Proxy (NRIC/FIN or mobile number) and PayNow Nickname

- Inform sender to send funds to your designated Proxy, using the PayNow option on his/her bank’s internet banking or mobile banking platform

Sending Funds:

- Login to HL Connect Mobile Application

- Under ‘Transfer’, select the proxy Type to transfer

- Enter the Proxy type (NRIC/FIN or mobile number) and Proxy details

- Enter the transaction amount, Account paying from and other details - Verify details, and submit

- ANEXT Bank

- ANZ

- BNP Paribas

- BOC

- CIMB

- Citibank

- DBS Bank/POSB

- Deutsche Bank

- GLDB

- GXS

- HL Bank

- HSBC

- ICBC

- JP Morgan

- MariBank

- Maybank

- OCBC

- RHB

- SMBC

- Standard Chartered Bank

- Trust

- UOB

- Grab Financial Group

- Liquid Group

- Nium

- Singtel Dash

- Wise

- Xfers

PayNow is being operated by a third-party service provider appointed by the industry-wide scheme owner for PayNow.

In order to facilitate seamless lookups of PayNow proxies across participating banks, all PayNow related data will be stored in a central database operated by the third-party service provider. Adequate measures have been implemented to ensure the integrity, security and confidentiality of this data.

A PayNow Proxy is a personal identifier that you can link to your bank account.

Existing customers with HL Bank current/savings accounts can link the following proxies to their bank account:

- NRIC or FIN number;

- A mobile number (local or foreign) that you have registered with HL Bank.

Please note that you can only register your bank-registered NRIC/FIN number and mobile number as PayNow Proxies.

Yes, you may link both Proxies (NRIC/FIN and mobile number) to the same bank account.

No. If you have already linked your Proxy to a HL Bank account and wish to register the same Proxy with another bank, you will need to first de-register the Proxy from your HL Bank account (using the “Manage PayNow ID” option), before you can register it with another bank.

When you link a PayNow Proxy to your bank account, you will be asked to enter a PayNow nickname as well. You are encouraged to choose a nickname that can help others identify who you are. This is because when a sender wishes to transfer money to you via PayNow, he/she will enter your PayNow Proxy and perform a lookup. The lookup will return your Nickname and will allow the sender to verify that he/she is indeed transferring money to the right person.

Yes, you may change your PayNow Nickname via the “Edit” option on HLB Connect or HL Connect mobile application.

Yes, you may change the bank account linked to your PayNow proxies using the “Edit” option on HLB Connect or HL Connect mobile application.

The maximum limit for PayNow transfers is the same as of your daily local transfer limit. You can manage this limit online via HLB Connect.

You can check the recipient's PayNow name which will be shown on the screen.